Articles

How to personalize FAST channels and boost advertising revenue

You are here:

THE EVOLUTION OF FREE AD-SUPPORTED TELEVISION

The media & entertainment industry’s landscape has evolved dramatically. Just within the last ten years, the TV industry and how people watch it has been radically transformed thanks to technology and business model innovation.

We witnessed the birth of connected television (CTV), subscription video on demand (SVOD), ad-supported video on demand (AVOD), and other avenues for delivering and watching video content.

The speed at which the market has evolved is evident in the seemingly endless stream of neologisms that it has produced:

- OTT (over-the-top television): It is the umbrella term for TV content delivered over the internet instead of broadcast or cable TV channels. OTT includes everything from streaming SportsCenter highlights on a phone, to watching “So You Think You Can Dance” clips on a laptop, to binging “The Office” on a television set through Peacock’s Apple TV app. In simpler terms, if you use the internet to watch it, it’s OTT, regardless of the device used.

- CTV (connected television): It is streaming video on a television set, either with a smart TV or with the help of a streaming device, such as Amazon Fire TV Stick, Chromecast, and Roku. In layman’s terms: if it’s viewed on television and streamed via the internet, it’s CTV.

- SVOD (subscription video on demand): As the name suggests, these types of streaming services require a subscription to view their content, like Netflix, Disney+, HBOMax, and Amazon Prime Video. SVOD is, in this respect, more of a business model than a technology platform.

- TVOD (transactional video on demand): Streaming services where consumers can purchase content on a pay-per-view basis. TVOD platforms can deliver higher revenues per viewer (ARPU) by offering consumers timely access to the most recent releases in early availability windows, and sporting events in real-time.

- AVOD (ad-supported video on demand): These are streaming video services that are funded by advertising. Some of the largest and most well-known AVOD service providers include YouTube, Facebook Watch, and Peacock.

- FAST (free ad-supported television): Streaming services that are free to the consumer and ad-supported and that, crucially, offer a combination of “linear” and on-demand programming. As we will explain later on, FAST channels can be of various kinds but, today, two main types seem to be winning the adoption race in the market. The first is vertical or thematic channels that are created around a specific genre or interest, such as sci-fi, cooking, crime, or gaming). The second is branded channels that offer content about products, services, and values of companies or offer premium content for which they have the rights. These FAST channels can be available across multiple operating systems via syndication or exclusively delivered on one specific aggregation service or operating platform.

What is the difference between AVOD and FAST?

AVOD content can be monetized with ads without the need of a subscription – as YouTube does – or by creating cheaper, ad-supported tiers – e.g. Peacock, Hulu. Some believe that the birth of AVOD was something we could have expected, a way of the natural order of things reasserting itself. This happened because, as the last 30 years or so demonstrated, both pay-TV and advertising-funded television are vital sources of income for content owners and of audiences for big-budget advertisers.

A recent Omdia report shows that AVOD will reach 260$ billion by 2025. This is a sign that viewers aren’t necessarily anti-advertising when watching TV, rather they are no longer willing to watch ads for 30% of the time while paying for expensive cable bundles. They are instead amenable to ad-supported streaming content if that means they pay no subscription and as long as the ad load isn’t overbearing.

FAST platforms are pretty much the same thing as AVODs, with the key difference being that they include both ad-supported on-demand content and ad-supported continuous TV content (aka linear channels). To monetize FAST, operators leverage digital ad insertion (DAI) technologies and programmatic tools, also collectively known as addressable TV advertising technologies.

Another difference between AVOD and FAST is that it is far easier and cheaper to create a FAST channel than an AVOD streaming platform. Content-rich operators can develop a FAST channel for every niche for which they have enough content to suggest, and distribute it throughout aggregators’ services. Plus, with FAST, companies can see their ROI almost immediately.

At the end of the day, AVOD and FAST both use advertising to monetize their inventories. The difference between ad-supported TV and cable or SVOD is the price that the customers are paying. AVODs and FASTs are usually free or cheaper ad-free, typical streaming subscriptions (Hulu Premium plan is 50$/year). In the case of cable TV, in the US, viewers pay on average 2,609$/year, while the Basic Netflix plan costs 120$/year. While most SVOD plans are vastly cheaper than a full-pay TV bundle subscription, households have multiple streaming subscriptions. In the US, the average household subscribes to four different SVOD services, spending more than 500$/year.

With FAST, consumers can always have something playing in the background and consume tons of content without breaking the bank. FAST also shifts the focus of operators away from obsessing over subscribers’ churn and towards audience building. That is why the promotion of FAST channels in this ecosystem is paramount. FAST streaming services mitigate audiences’ subscription fatigue, and can effectively be leveraged to promote premium offerings such as SVOD or pay-per-view options.

The state of the FAST market

Today, in the US, FAST channels’ aggregate audience is already larger than the audiences of all cable and satellite TV operators, combined. They are, for all intent and purposes, a free replacement for traditional linear TV.

Why are operators investing in this type of streaming service now more than ever?

From a technical point of view, all FAST platforms are newly built and they are cloud-native, thus allowing nimble and efficient go-to-market strategies. They don’t have channel or format limitations, they can be watched on any device, and they are well suited for virtual linear channels and for the more advanced versions of personalized linear channels.

FAST content acquisition strategies are also capital efficient, as original content is not a significant part of the content available on FAST and operators usually leverage content that already exists. Plus, there are already aggregators through which brands can distribute their channels and programming.

Given the lower costs, some smaller players choose to create a FAST channel to promote their products and shows. Sometimes this strategy is used to market-test the eventual development of new OTT services.

According to Harmonic, today the main FAST platforms in this “new market” are Pluto TV (ViacomCBS), Xumo (NBCU), Tubi (Fox), Peacock (NBCU), The Roku Channel (RokuTM), IMDbTV (Amazon), and Samsung TV+ (Samsung), LG, and Vizio Watchfree.

In the last few months, we’ve witnessed several moves by major players that signal the increasing importance of FAST:

- Paramount+ added a new feature that can provide linear channels around specific themes (SpongeBob, StarTrek, and more).

- At the end of 2021, Pluto TV decided to switch from AVOD to FAST. After just six months, the team at Pluto managed to deliver thematic channels, pop-up channels (channels that are added to the existing lineup for a limited time only, for example during important events), and more.

- Similarly, there is Peacock TV with its so-called live channels.

WHY INVEST IN FAST?

Given all the buzz, these industry developments, and what we are hearing consistently from our clients and partners, we are convinced that FAST platforms may will be the next big thing in the M&E industry.

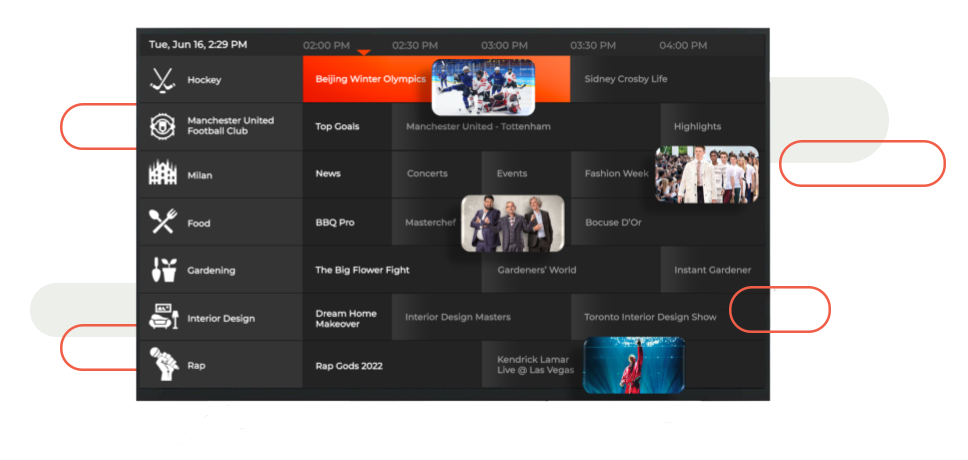

Creating a FAST channel and putting it on an existing platform will no longer be enough to maximize the value of the linear content catalog. Operators will need to deliver a better user experience than old-school channel surfing. We are talking about personalization technology that we are accustomed to seeing in VOD, but applied to FAST content, the so-called Personalized Linear Channels (PLC).

Personalize content programming for each viewer

FAST channels, as we have explained, are linear by design. Once a viewer turns on the spy drama channel, they will only see content around that specific theme. This is critical, as Justin Fromm, Head of Research at LG Ads Solutions, points out in this article, “to the key role the linear nature of FAST channels [has] in helping consumers avoid decision paralysis, while shorter ad breaks make for a better consumer experience”.

By analyzing the habits and tastes of viewers, media brands can personalize linear channels to offer a better experience. In practice, two viewers could watch the same linear streaming channel at the same time but watch entirely different content streams. For example, while watching the Cooking Channel viewer A could see a cooking show while viewer B could see an Italian cooking lesson.

This is an experience paradigm that users of audio streaming services like Spotify, or short-form video, are all too familiar with.

This “Spotifyization of Television” is the goal that FAST channels aim to achieve. As Alan Wolk said “At some point soon, I suspect we’ll have personalized linear channels too, either entire, pre-populated channels (“Alan’s Crime Channel”) waiting for you, a personalized YouTube-like autoplay channel once the show you’ve just watched is over, or both.” In the meantime, you could do something else entirely, like cleaning or getting ready to go out.

Extend content shelf life and leverage the catalog’s long tail

Launching a FAST channel doesn’t equate to investment in original content. Quite the opposite. That means that FAST’s strategic imperative is to take advantage of the entire catalog and increase distribution effectiveness.

The great thing about this approach is that /operators that have the content can easily create niche FAST channels.

Thanks to automatic content bundling, this can be done at scale. The critical keyword in this process is automatic since automation enables operators to maximize the return on their initial content investments thanks to low-cost, automatic, niche curation.

Boost inventory monetization

According to Statista, the TV advertising revenue worldwide is expected to reach 159$ billion in 2022, up from 151$ billion generated in 2021. And the revenue is projected to continue growing in the upcoming years.

Using niche personalized FAST channels will give media brands the chance to gain more audiences in specific niches. With precious and granular audience analytics and segmentation, they can boost ad effectiveness and targeting.

FAST can potentially bring together the reach of traditional linear television programming with the unique ability to precisely target content and advertising that is commonplace on the internet. With the right tools and sufficient scale, operators can deliver advertisers endless, ever narrowers niche audiences.

FAST can also complement traditional advertising business models. When premium ad inventory is sold out and there is a need to supply more inventory, FAST can do exactly that quickly by scaling the process of packaging niche audiences for advertisers and greatly expanding linear TV’s ad inventory.

Exploit the marketing possibilities

For some operators, FAST represents a formidable acquisition channel, a cheaper way to capture new potential subscribers to premium services, while collecting rich first-party data to optimize upselling and increase conversions.

If a FAST platform offers free personalized linear channels, and the subscriber in return gets targeted content with low effort and investment, an upgrade offer will be more easily converted. FAST is the perfect onboarding and activation vehicle.

FAST can be a good way to develop the audience and build high-quality first-party data, which is critical to creating marketing campaigns that foster more meaningful engagement and better personalization.

CHOOSE THE RIGHT SOLUTION

All the promise of FAST is hard to realize at scale without advanced technology such as AI. That’s where ContentWise can help.

Having spent more than a decade building the most comprehensive recommendation, personalization, and UX orchestration software for SVOD and linear TV, ContentWise is uniquely positioned to help operators implement a personalization strategy for FAST.

There are two ways to look at the personalization of FAST channels. The first is personalizing the ads themselves (DAI). The second is personalizing the content stream on individual personalized linear channels (PLC). We believe that the two approaches go hand-in-hand.

ContentWise’s UX Engine for Personalized Linear Channels solution allows PayTV operators, aggregators, content-owners, and streaming services to stitch together VOD content and automate the creation of linear channel lineups and playlists.

Our AI-driven automation tools offer the opportunity to scale programming operations by automatically generating hundreds of linear and thematic channels to enrich the lineup. Our technology enables our customers to scale the process of assembling thematic, pop-up, or localized virtual channels, potentially supplying an endless number of FAST channels, ranging from local news to fitness to fishing.

In this context, promotion and targeting of the right FAST channel to the right audience will be paramount. Marketers will have to leverage context and interest signals to identify and target the perfect FAST channel for each viewer.

With ContentWise, editors can personalize the content scheduling of the channel based on viewers’ habits and tastes. By using machine learning technology, ContentWise optimizes the linear channel’s playlist with deeper granularity. Thus viewers can get an ultimate lean-back experience and forget entirely about deciding what to watch next.

Channels can be personalized at different levels. From the most basic strategies to fully automated and hyper-personalized TikTok-style “ForYou” channels with relevant cross-genres and cross-theme content to match ever-changing viewers’ tastes.

By mixing recommendation algorithms with editorial curation, operators can get a higher level of personalization in the selection and targeting of content scheduling and channel definition.

While automating the personalized content programming of each linear channel, it is possible to put in place brand safety and contextual targeting guardrails to ensure advertisers will be able to control which content surrounds their ads and their brands.

FAST channels are here to stay and more players will enter the market. In order to get the most out of the investment and move towards the next level of linear TV engagement and monetization, operators should invest in linear user experience personalization.

ContentWise UX Engine for Personalized Linear Channels is the solution that lets video streaming operators automatically create thematic channels and personalize their linear content programming.

Maximize the lifetime value of your content inventory while expanding your ad inventory. Optimize FAST channels with Personalized FAST channels and embrace the new era of linear television.

4 UX USE CASES TO CREATE AND PERSONALIZE LINEAR CHANNELS

Read our solution brief to find out about them

Related News

Articles

Like VOD but in four dimensions? FAST channel programming automation and personalization with Contentwise Playlist Creator

Thanks to automation and AI, Playlist Creator, leverages content recommendation recipes to generate FAST channel playlists that are fed to cloud playout systems.